Unleashing the Potential of Time Series Neural Networks

The Power of Time Series Neural Networks

Time series data, which consists of observations recorded at different points in time, is prevalent in various fields such as finance, weather forecasting, and signal processing. Analysing and predicting patterns in time series data can be complex due to its sequential nature and dependency on previous observations.

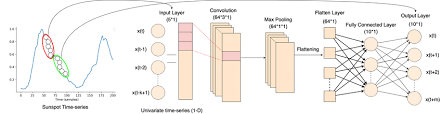

Neural networks have emerged as a powerful tool for modelling and forecasting time series data. Time series neural networks leverage the ability of neural networks to learn complex patterns and relationships from historical data.

One popular type of time series neural network is the Recurrent Neural Network (RNN). RNNs are designed to handle sequential data by maintaining a memory of past inputs through recurrent connections. This memory enables RNNs to capture temporal dependencies in time series data.

Another advanced variant of RNNs is the Long Short-Term Memory (LSTM) network. LSTM networks address the vanishing gradient problem in traditional RNNs, making them more effective at capturing long-term dependencies in time series data.

Time series neural networks can be used for various tasks such as forecasting stock prices, predicting weather patterns, and analysing physiological signals. By training on historical data, these networks can learn patterns and trends that help make accurate predictions about future observations.

In conclusion, time series neural networks offer a powerful approach to analysing and predicting sequential data. Their ability to capture complex patterns and temporal dependencies makes them invaluable tools for a wide range of applications. As technology continues to advance, we can expect further innovations in the field of time series neural networks that will enhance our ability to understand and forecast time-dependent phenomena.

Understanding Time Series Neural Networks: Key FAQs and Insights

- What is a time series neural network?

- How does a time series neural network differ from traditional neural networks?

- What are the advantages of using neural networks for analysing time series data?

- Which types of neural networks are commonly used for time series analysis?

- How do recurrent neural networks (RNNs) handle sequential data in time series analysis?

- What is the role of Long Short-Term Memory (LSTM) networks in time series forecasting?

- Can time series neural networks be applied to financial forecasting and stock market predictions?

- How can one train a time series neural network to make accurate predictions?

What is a time series neural network?

A time series neural network is a specialised type of neural network designed to analyse and forecast sequential data points recorded over time. Unlike traditional neural networks, which process data independently, a time series neural network considers the temporal relationships between observations to make predictions about future values. By leveraging recurrent connections and memory mechanisms, such as those found in Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks, time series neural networks excel at capturing patterns and dependencies within time series data. These networks are invaluable tools for tasks like stock price prediction, weather forecasting, and trend analysis, where understanding the sequential nature of data is crucial for making accurate predictions.

How does a time series neural network differ from traditional neural networks?

A time series neural network differs from traditional neural networks in its ability to handle sequential data with temporal dependencies. While traditional neural networks process data independently of the order in which it is presented, time series neural networks are specifically designed to capture patterns and relationships that exist over time. By incorporating memory mechanisms such as recurrent connections or advanced architectures like Long Short-Term Memory (LSTM) networks, time series neural networks can effectively model and predict sequential data, making them well-suited for tasks such as forecasting stock prices, analysing physiological signals, and predicting weather patterns. The focus on temporal dynamics sets time series neural networks apart from traditional neural networks and enables them to excel in applications where understanding the sequence of events is crucial.

What are the advantages of using neural networks for analysing time series data?

When it comes to analysing time series data, neural networks offer a range of advantages that make them a powerful tool in the field. One key advantage is their ability to learn complex patterns and relationships from historical data, allowing them to capture intricate temporal dependencies present in time series datasets. Neural networks, such as Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks, excel at processing sequential information and can effectively model nonlinear relationships within the data. Additionally, neural networks can adapt and update their internal parameters during training, enabling them to continuously improve their predictive accuracy over time. Overall, the flexibility, adaptability, and capacity for learning intricate patterns make neural networks a valuable asset for analysing time series data with high accuracy and efficiency.

Which types of neural networks are commonly used for time series analysis?

In the realm of time series analysis, several types of neural networks are commonly employed to effectively model and predict sequential data patterns. Recurrent Neural Networks (RNNs) stand out as a popular choice due to their ability to retain memory of past inputs through recurrent connections, enabling them to capture temporal dependencies within time series data. Long Short-Term Memory (LSTM) networks, an advanced variant of RNNs, are also widely utilised for their enhanced capability in handling long-term dependencies and mitigating the vanishing gradient problem. These neural network architectures have proven instrumental in analysing and forecasting time series data across various domains, showcasing their versatility and effectiveness in capturing intricate temporal relationships.

How do recurrent neural networks (RNNs) handle sequential data in time series analysis?

In time series analysis, recurrent neural networks (RNNs) excel at handling sequential data by leveraging their unique architecture. RNNs are designed with recurrent connections that allow them to maintain a memory of past inputs as they process each data point in a sequence. This memory feature enables RNNs to capture temporal dependencies within the time series data, making them well-suited for tasks where the order of observations matters. By retaining information about previous inputs, RNNs can effectively model and predict patterns in time series data, providing valuable insights for various applications such as forecasting, anomaly detection, and pattern recognition.

What is the role of Long Short-Term Memory (LSTM) networks in time series forecasting?

Long Short-Term Memory (LSTM) networks play a crucial role in time series forecasting by addressing the challenge of capturing long-term dependencies in sequential data. Unlike traditional Recurrent Neural Networks (RNNs), LSTM networks are designed to retain information over extended periods, making them well-suited for analysing time series data with complex temporal patterns. The unique architecture of LSTM networks, with its gates that control the flow of information, enables them to remember important past observations while selectively forgetting irrelevant details. This capability allows LSTM networks to effectively model and predict future values in time series data, making them a powerful tool for accurate and reliable forecasting tasks.

Can time series neural networks be applied to financial forecasting and stock market predictions?

Time series neural networks have shown great promise in the realm of financial forecasting and stock market predictions. By leveraging the sequential nature of time series data, neural networks can capture complex patterns and trends that are crucial for making accurate predictions in volatile financial markets. These networks can analyse historical stock prices, trading volumes, and other relevant data to identify patterns that may indicate future market movements. While challenges such as data quality and model interpretability exist, time series neural networks offer a powerful tool for investors and analysts looking to gain insights into the dynamics of financial markets and make informed decisions based on predictive analytics.

How can one train a time series neural network to make accurate predictions?

Training a time series neural network to make accurate predictions involves several key steps. Firstly, it is crucial to preprocess the time series data by normalising it and handling missing values appropriately. Next, selecting the right architecture for the neural network, such as Recurrent Neural Networks (RNNs) or Long Short-Term Memory (LSTM) networks, is essential. Tuning hyperparameters, such as learning rate and batch size, through experimentation can significantly impact the model’s performance. Additionally, dividing the data into training and validation sets helps in evaluating the model’s performance and preventing overfitting. Regular monitoring and adjusting of the model based on its performance on validation data are also important to ensure accurate predictions. By following these steps diligently and continuously refining the model based on feedback, one can train a time series neural network effectively to make precise forecasts.